Payers

NOTE: See Customer Dashboard for definitions of payer features in the user interface.

Payers are the entities paying the recipient and filing the 1099 Form. 1099-Prep allows multiple payers for each customer.

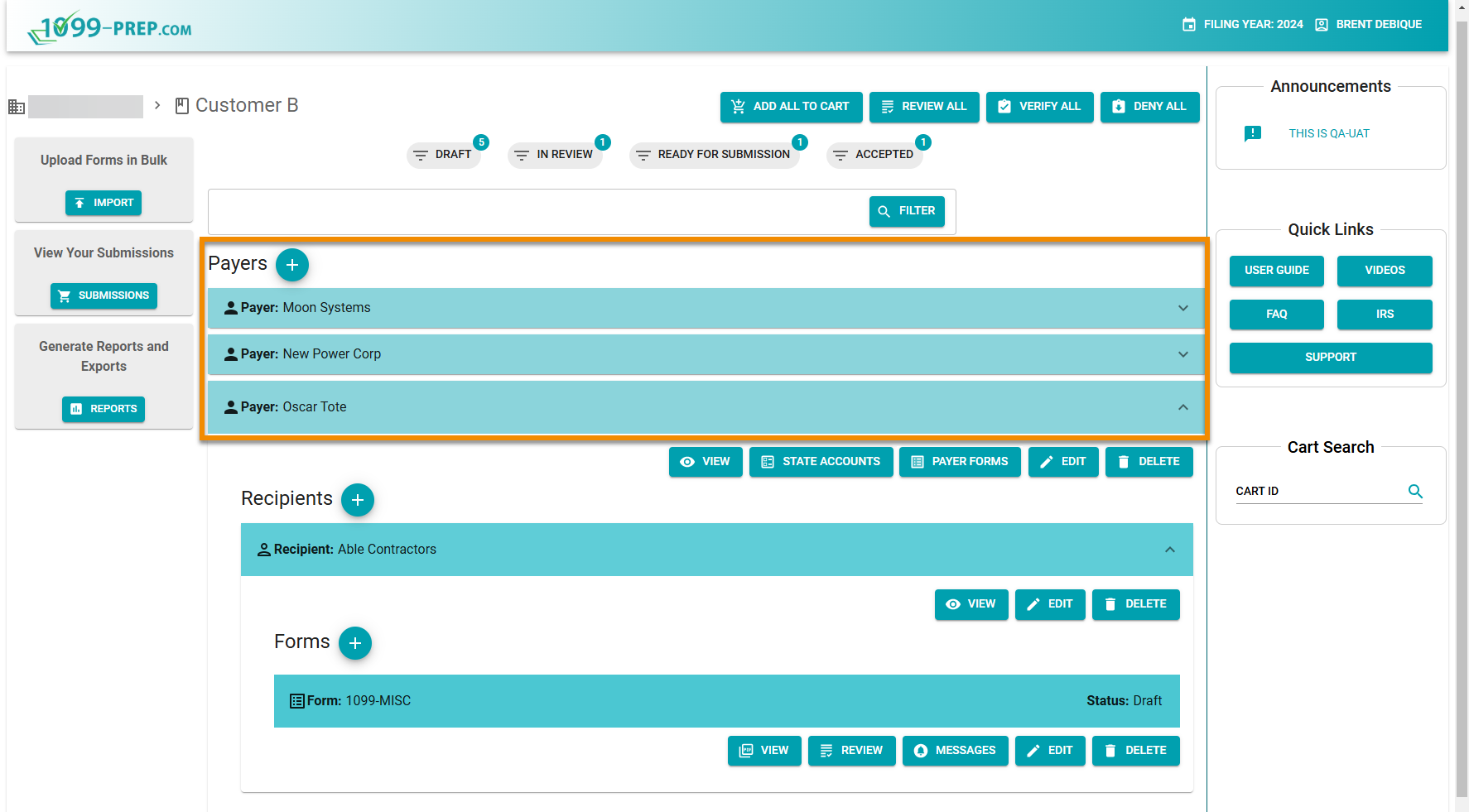

Use the Payer panel in the Customer Dashboard to track all the payers within a customer account as well as to add, edit, or delete payers and payer forms.

How you use payers depends on your organization and your role in it:

-

Accountants using Customers to represent Clients generally create one Payer per Customer for single-entity clients, and multiple Payers when filing for multi-entity companies with multiple subsidiaries and legal entities (or when reporting payments from an individual owner rather than the company).

-

Large corporations using Customers to represent Entities will likely only create a single Payer entity per Entity. Alternatively, if entity-level access permissions are not required, creating all legal entities as Payers under a single Customer drastically simplifies the import process, as 1099-Prep allows for a bulk import of all transactions across multiple Payers (or entities, in this case) from a single import file.

-

Small businesses preparing forms for their own company, only, will only need to create a single Payer representing the company itself. If an owner made any payments separate from those made by the company, you can create a separate Payer designated as an Individual rather than a Company (see below for more info).

Sections: