Adding Payers

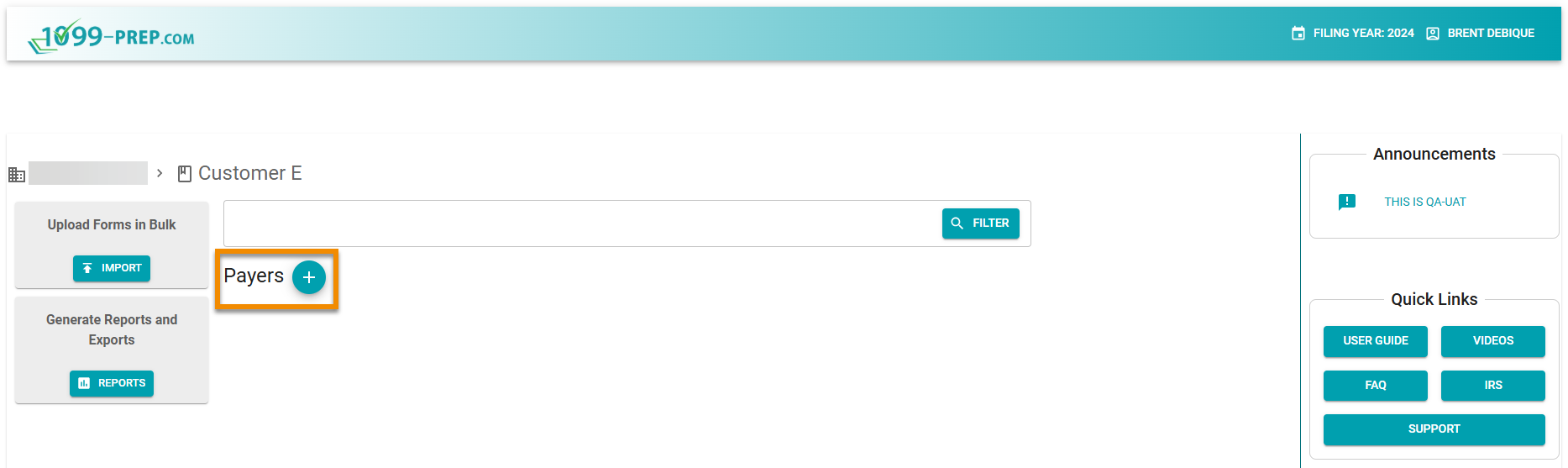

Payers are added to the customer display in the Customer Dashboard.

When you add a new payer, you are required to provide information about the payer. This information is generated on tax forms when you submit a form through 1099-Pep.

NOTE: For required payer information when adding a new payer, see Payer Field Definitions.

-

Optionally, use the Customer Filter to search for a customer account.

-

In the company dashboard, click a customer tile to access the customer account.

-

Click the

icon next to Payers in the Customer Dashboard.

icon next to Payers in the Customer Dashboard.

-

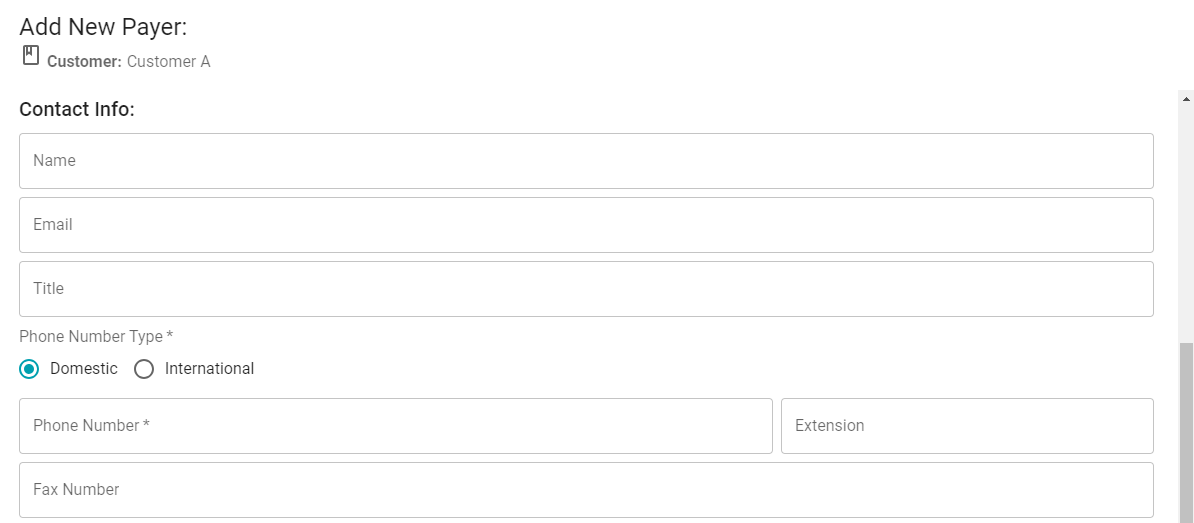

In the Add New Payer prompt, choose a Payer Type by clicking either the Individual or Company radio button.

NOTE: The Payer Type you select determines fields that must be filled in the Add New Payer prompt.

For definitions of fields in the Add New Payer prompt, see Payer Field Definitions.

-

Fill out information in Individual (or Company) fields.

-

In the Add New Payer prompt, scroll down to the Address fields and choose an Address Type by clicking either the US Address or Foreign Address radio button.

NOTE: The Address type you select determines fields that must be filled in for the address. For definitions of fields in the Add New Payer prompt, see Payer Field Definitions.

-

Fill out all required address fields.

-

In the Contact Info section, fill out all necessary fields. Ensure a Phone Number Type is selected and a Phone Number is entered in the field.

-

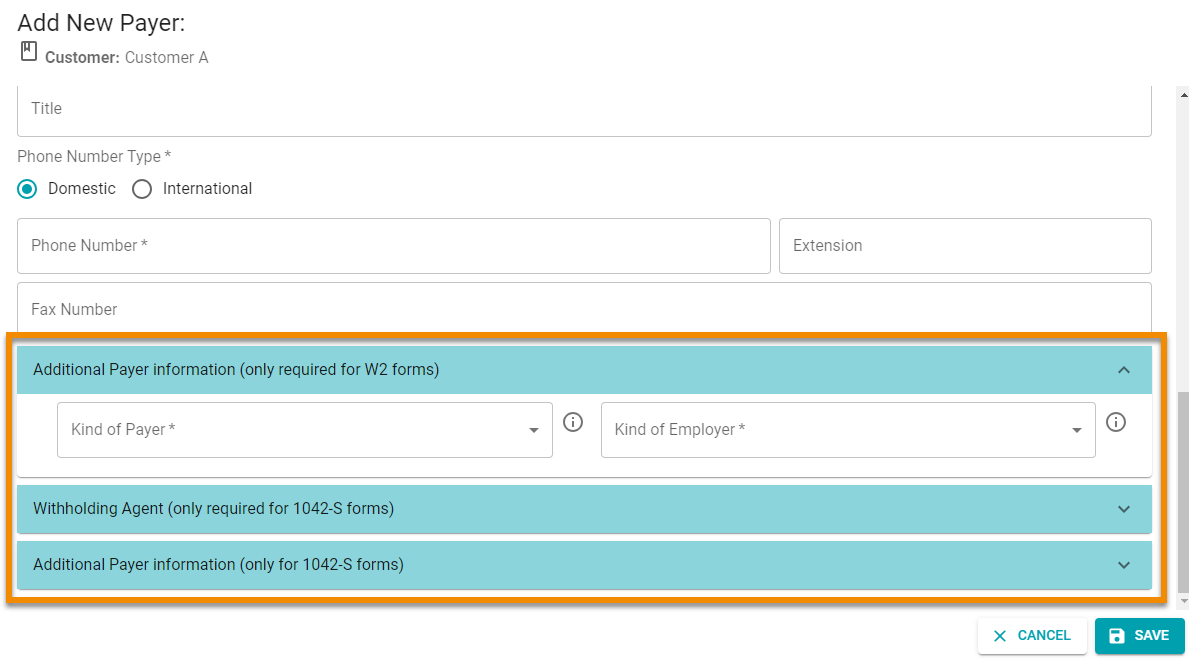

At the bottom of the Add New Payer prompt, click the

icon on the right-side of tiles to expand them.

icon on the right-side of tiles to expand them. As necessary, add Additional Payer Information for W2 and 1042-S forms and Withholding Agent for 1042-S forms in tiles.

NOTE: For definitions of fields in the Additional Payer information and Withholding Agent tiles, see Additional Payer Information and Withholding Agent Fields Definitions (W-2 and 1042-S Filers).

-

Ensure all required fields are completed in the Add New Payer prompts (i.e., fields with an asterisk [*]).

-

Click SAVE.

The payer displays in the customer of the Customer Dashboard.

Additional Information: