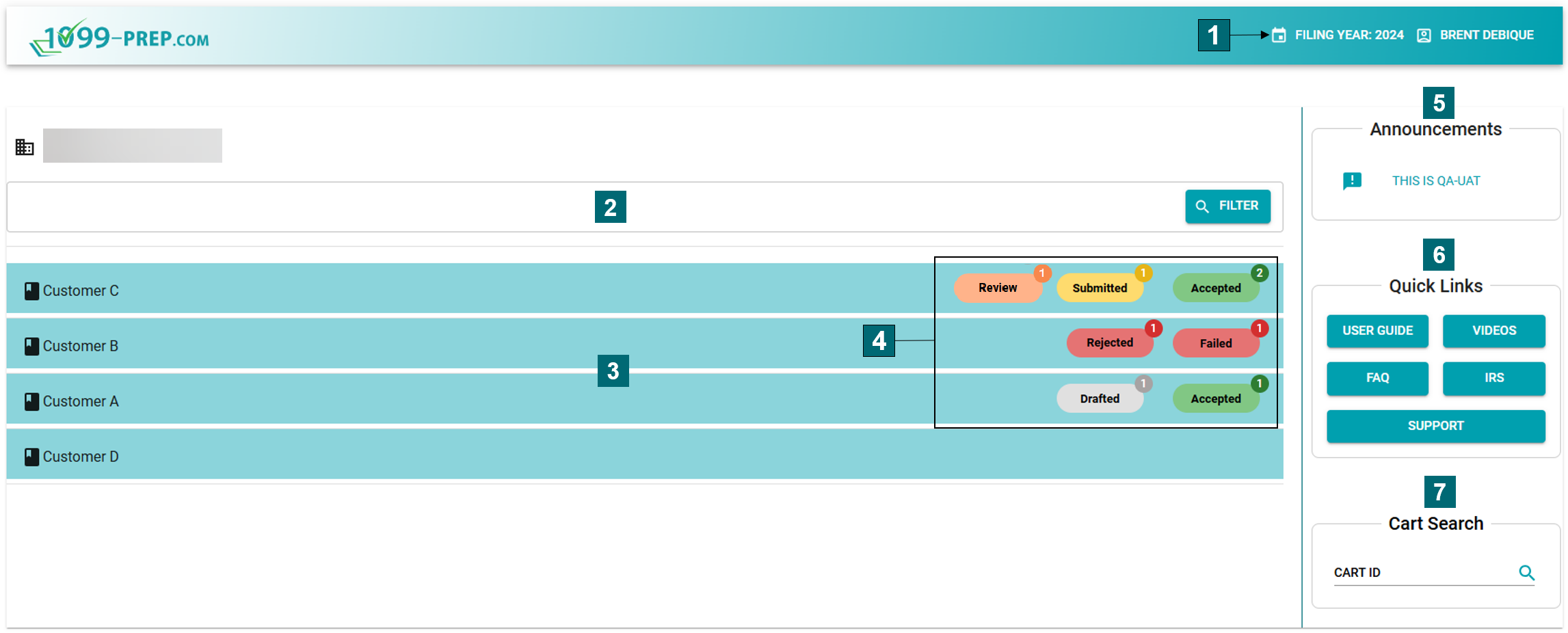

Company Dashboard

The Company Dashboard displays when you log in. It lists all customers associated with your company and the status of forms related to each customer. Users can search for customers and then click a customer tile to access the customer's dashboard. The side pane contains announcements, resources, and the ability to search for any cart of forms you created (see Cart Search).

Click a number in the image to navigate to a description of that feature in the table below.

|

Feature Name |

Definition |

|

|---|---|---|

| 1 | Filing Year | Click to select a tax filing year. Only tax forms submitted for the selected year displays for customers in 1099-Prep. The default selection is always the current tax filing year (see Selecting a Filing Year). |

| 2 | Customer Filter | Enter a customer name in the filter field and click the FILTER button to filter customers related to your company. Text entered in the field will filter all available customers in the Customer List (see Searching for Customer Accounts). |

| 3 | Customer List |

Displays a list of most accessed customers accounts (see Customers). Click a tile to access that customer's account. The customer account most accessed displays at the top of the list. NOTE: Customers are added and configured by your 1099-prep administrator (see User Management). |

| 4 | Customer Form Status |

A visual indicator of the current status of forms associated with the costumer account. The number of forms in the status displays in circles of each status. Definition of statuses are: Accepted: Forms accepted by the IRS. Drafted: Forms were created for a recipient of payers, but it has not been submitted to the IRS. Failed: Forms have failed the submission process because of a validation issue. Failed forms can be reopened, edited, and resubmitted using the Reopen feature (see Reopening Forms). Rejected: Forms rejected by the IRS. Rejected forms can be corrected and resubmitted (see Correcting Forms). Review: Only displays if the review feature is enabled for your organization. Displays if formsare in a review status and still must be verified or denied by users before they can be added to the cart and submitted. Submitted: Forms were added to the cart and submitted to the IRS. When the submission process is complete, the status of the form will automatically change to "Accepted." |

| 5 | Announcements |

Displays important notifications from the 1099-Prep team, such as filing dates. |

| 6 | Quick Links |

Displays links to the following resources: USER GUIDE: A PDF document that contains detailed information on all features of 1099-Prep. VIDEOS: Links to 1099-Prep's library of training videos. FAQ: Links to a page of frequently asked questions about 1099-Prep. IRS: Link to the official IRS website where you can find more information about the tax process and tax forms. SUPPORT: Displays a prompt where you can submit to the 1099-Prep Support team a request for assistance. Requests should contain a summary and detailed description of the technical issue experienced in 1099-Prep. Support will reply to the primary email on file for your Company. |

| 7 | Cart Search |

Enter a Cart ID number to find and view that cart of tax forms for the tax filing year selected in 1099-Prep. 1099-Prep retains all tax forms of a customer added to a cart. NOTE: Ensure you have selected the correct Filing Year before searching. Carts in the "Pending" status cannot be submitted this way. To submit a Pending cart, access teh custoemr account of the cart and click the CART button in the left-side panel (see Accessing the Cart). see Cart Search. |