Adding and Preparing Forms

-

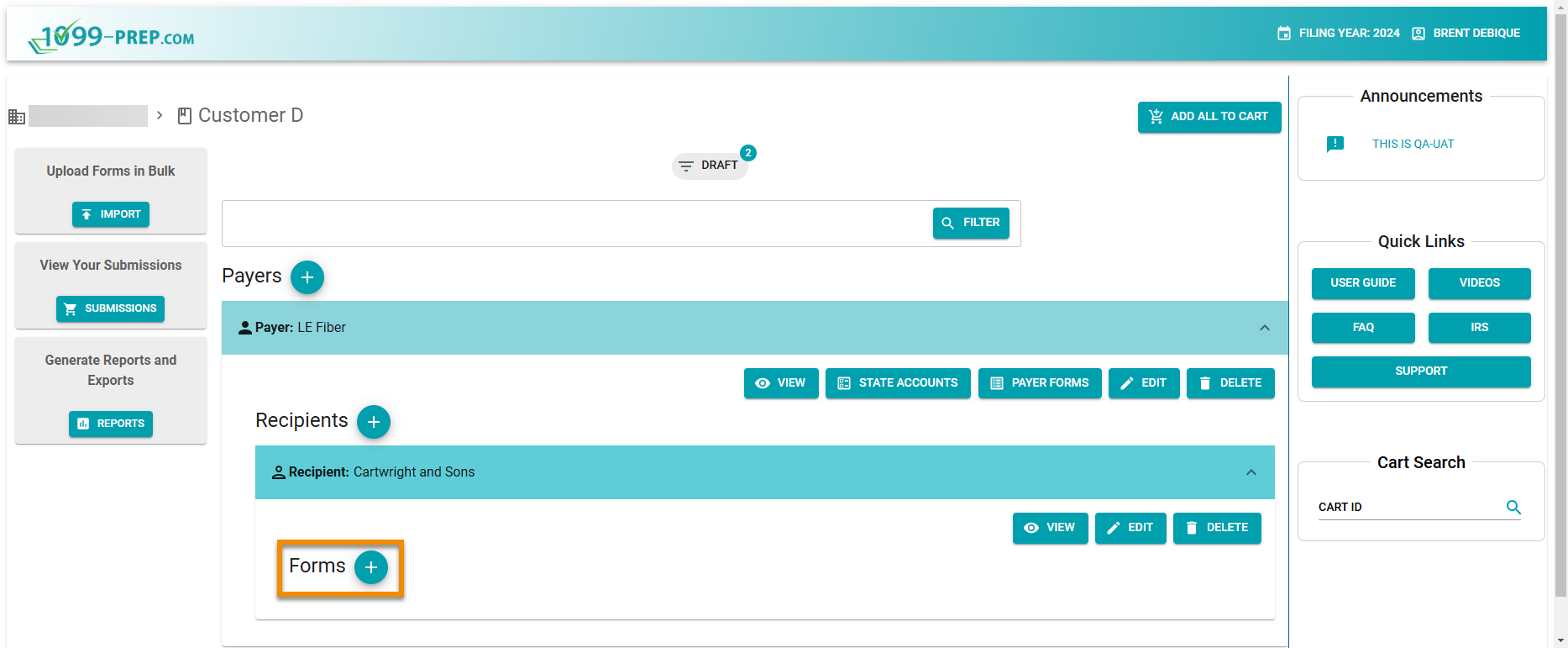

Optionally, use the Customer Filter to search for a customer account.

-

In the company dashboard, click a customer tile to access the customer account.

-

Click the expand tile arrow

on a payer tile.

on a payer tile. -

Click the expand tile arrow

on a recipient tile.

on a recipient tile. -

In the recipient tile, click the

icon next to Forms.

icon next to Forms.

-

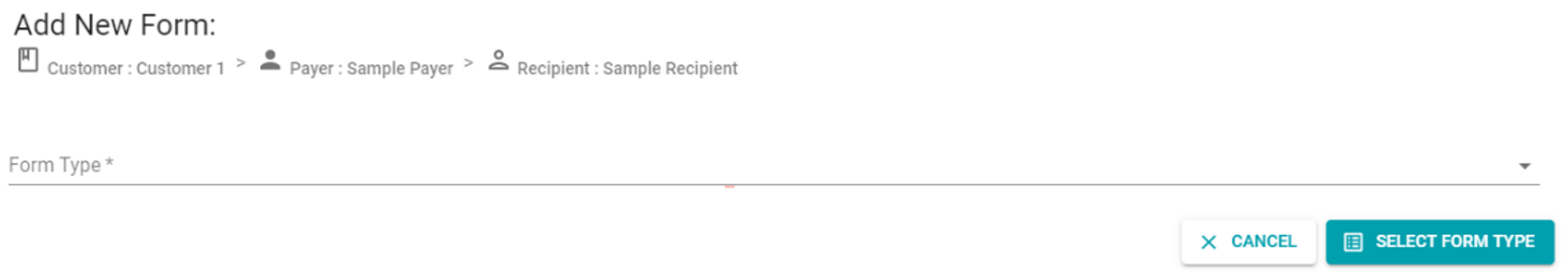

In the Add New Form prompt, select a Form Type from the drop-down menu.

-

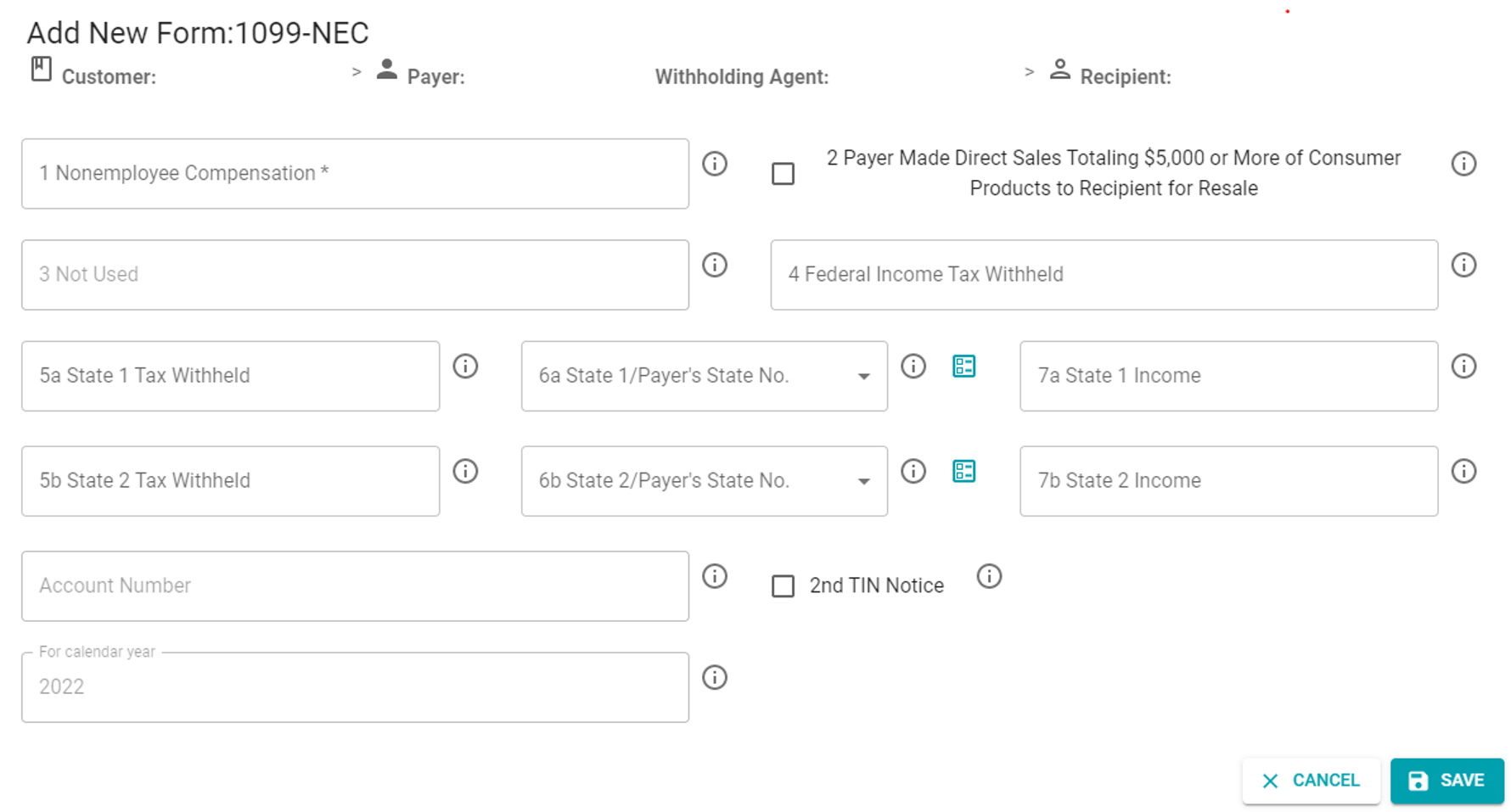

Click SELECT FORM TYPE. The form fields displays in a new prompt (see example image below).

-

Fill out form fields as necessary.

NOTE: Some tax form fields have icons next to them that allow you to add pre-configured information to the field (i.e., 1042-S and W-2 forms). Icons are:

-

Manage State: Click to add pre-configured state information to the field (see Manage State Accounts).

Manage State: Click to add pre-configured state information to the field (see Manage State Accounts). -

Manage Recipient: Click to add pre-configured recipient information to the field (see Recipient Field Definitions).

Manage Recipient: Click to add pre-configured recipient information to the field (see Recipient Field Definitions). -

Manage Payer / Manage Withholding Agent: Click to add pre-configured payer information to the field (see Additional Payer Information and Withholding Agent Field Definitions (W-2 and 1042-S Filers)).

Manage Payer / Manage Withholding Agent: Click to add pre-configured payer information to the field (see Additional Payer Information and Withholding Agent Field Definitions (W-2 and 1042-S Filers)).

Pre-configured information is typically set from the payer or recipient profiles using the Edit icon:  .

.

-

Click SAVE.

The form is listed as a tile under the recipient in the "Draft" status.

Once forms are completed, add the to the cart for payment and submission (see Cart and Payment).