Making Payment

After adding forms to the cart, you can make payment. Once payment is made, forms are automatically submitted to federal and state for processing.

Acceptable payments are:

-

A prearranged payment method based on your company invoice agreement with 1099-Prep.

NOTE: If you need information on your company’s invoicing agreement, contact Support.

-

By credit or debit card.

To make a payment:

-

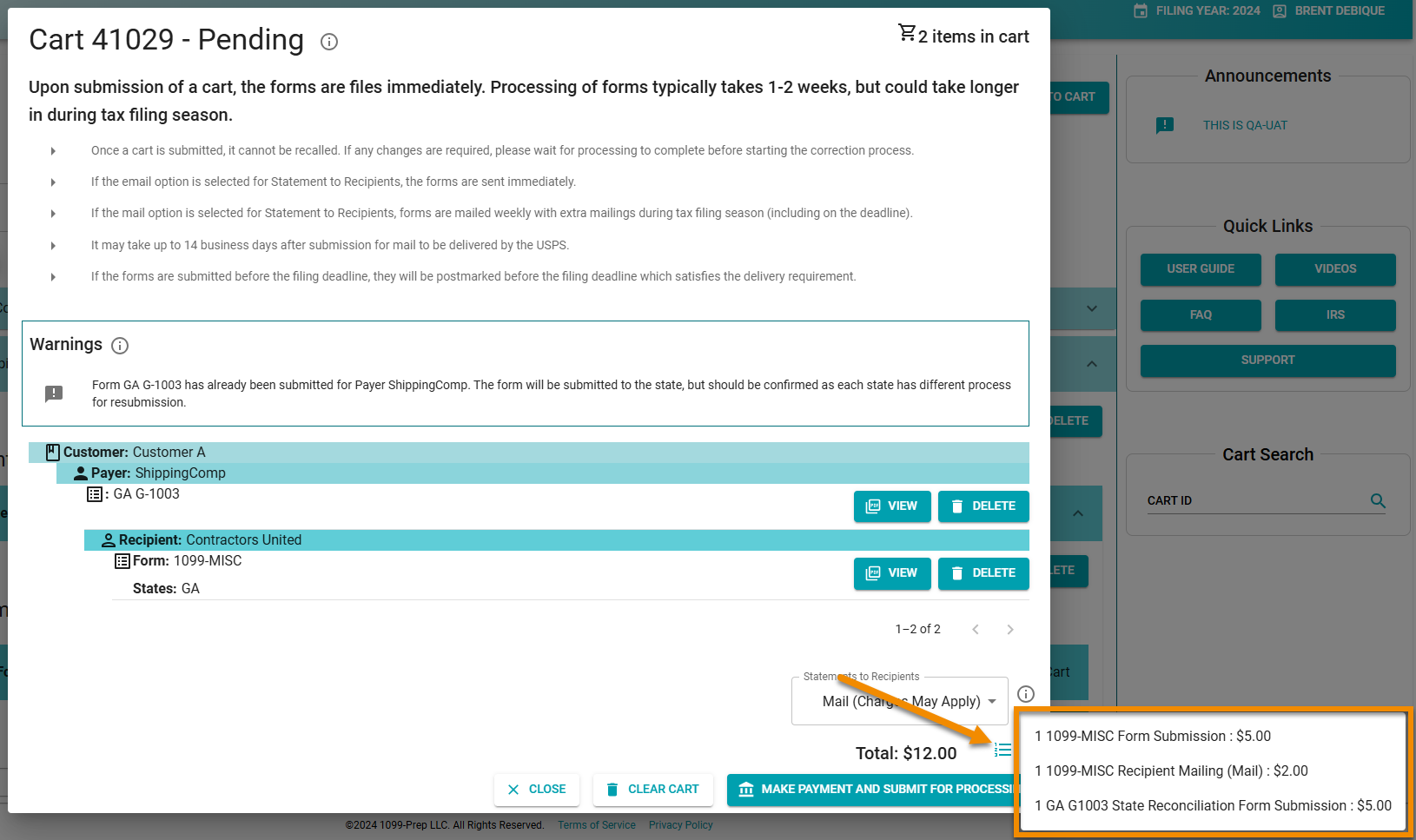

NOTE: If a state reconciliation tax form is submitted with an related tax form, the state reconciliation form is listed under the related Payer in the cart (see Adding State Reconciliation Forms to the Cart).

-

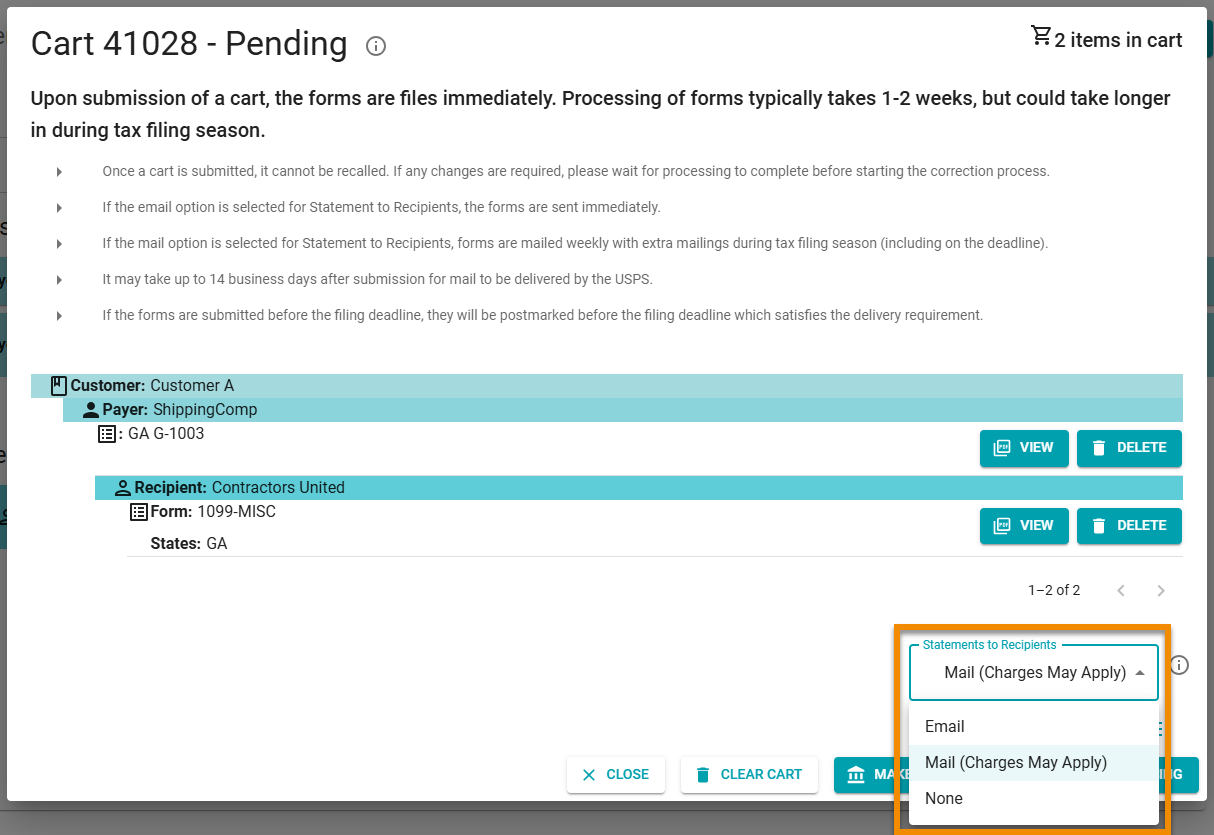

Click the Statements to Recipients drop-down menu and select an option (see Sending Statements to Recipients).

-

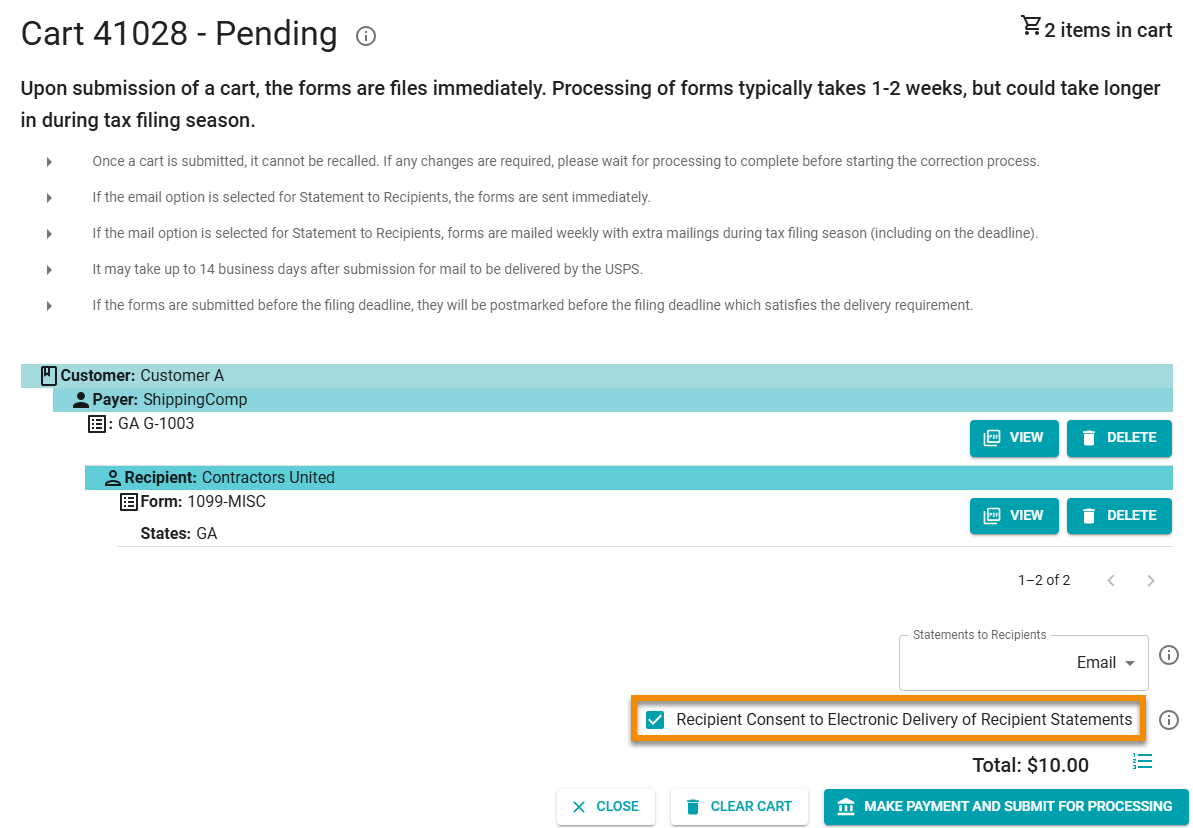

If sending statements to recipients by email, check the Recipient Consent to Electronic Delivery of Recipient Statements box (see Sending Statements to Recipients).

-

Optionally, Click the click the Detailed Cost List icon:

to see a break-down of cost, by form and statement recipient submission.

to see a break-down of cost, by form and statement recipient submission.

-

Click MAKE A PAYMENT AND SUBMIT FOR PROCESSING in the cart.

IMPORTANT: If your organization has an invoicing agreement with 1099-Prep, you will NOT be required to enter credit card information. You may be prompted to enter customer specific information prior to submission (e.g., engagement numbers). Contact Support for more information.

-

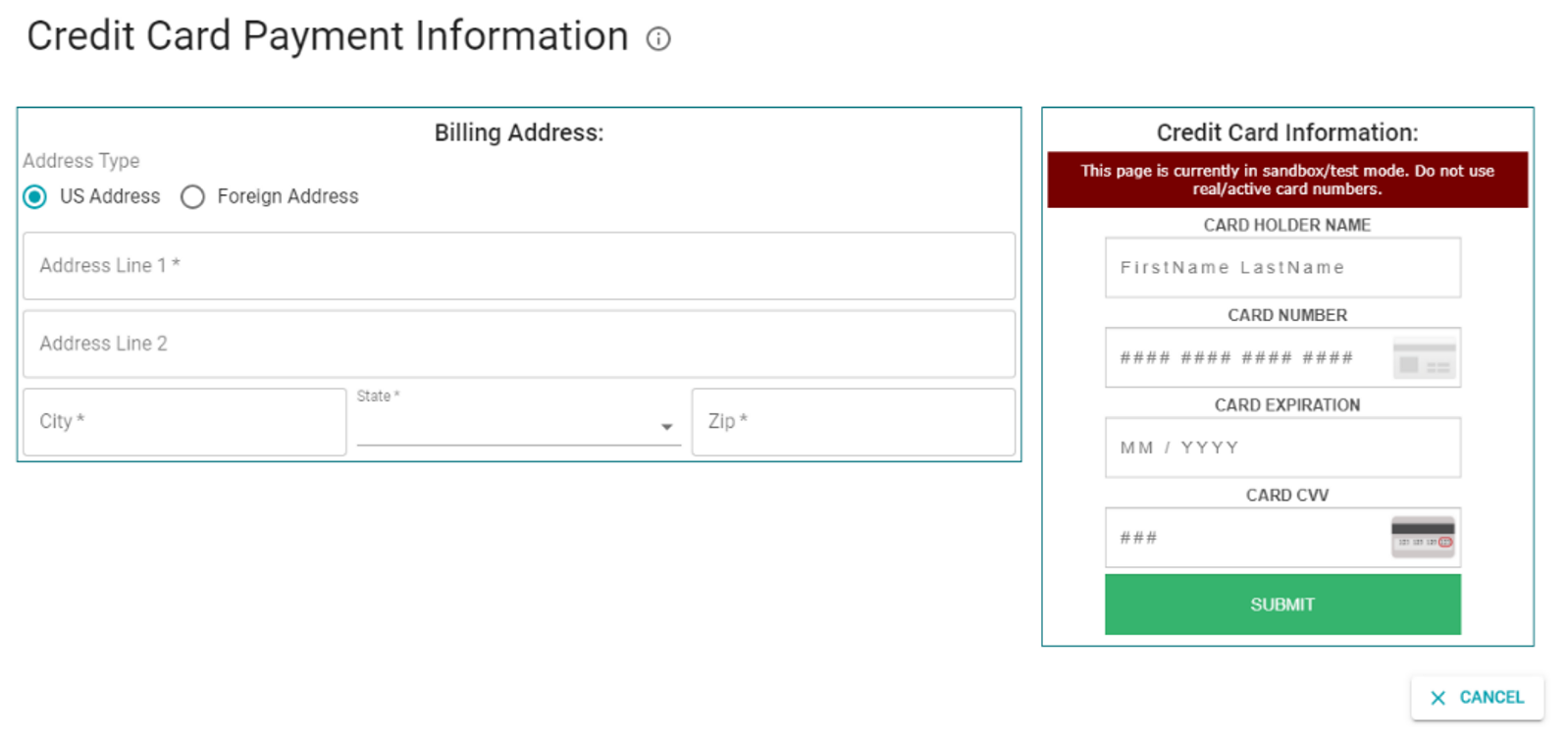

(Optional) If you do NOT have an invoicing agreement with 1099-Prep, the Credit Card Payment prompt displays. In these cases, you must pay by credit or debit card.

Enter your credit or debit card information in the fields and click SUBMIT.

After making payment, 1099-Prep performs a final validation of forms BEFORE charging your payment method and submitting the forms to the IRS and/or state.

If issues are found with any form, payment is NOT processed and the status of the form(s) changes to “Failed”. Payment will not be processed for all forms in the cart (see Failed Submissions).

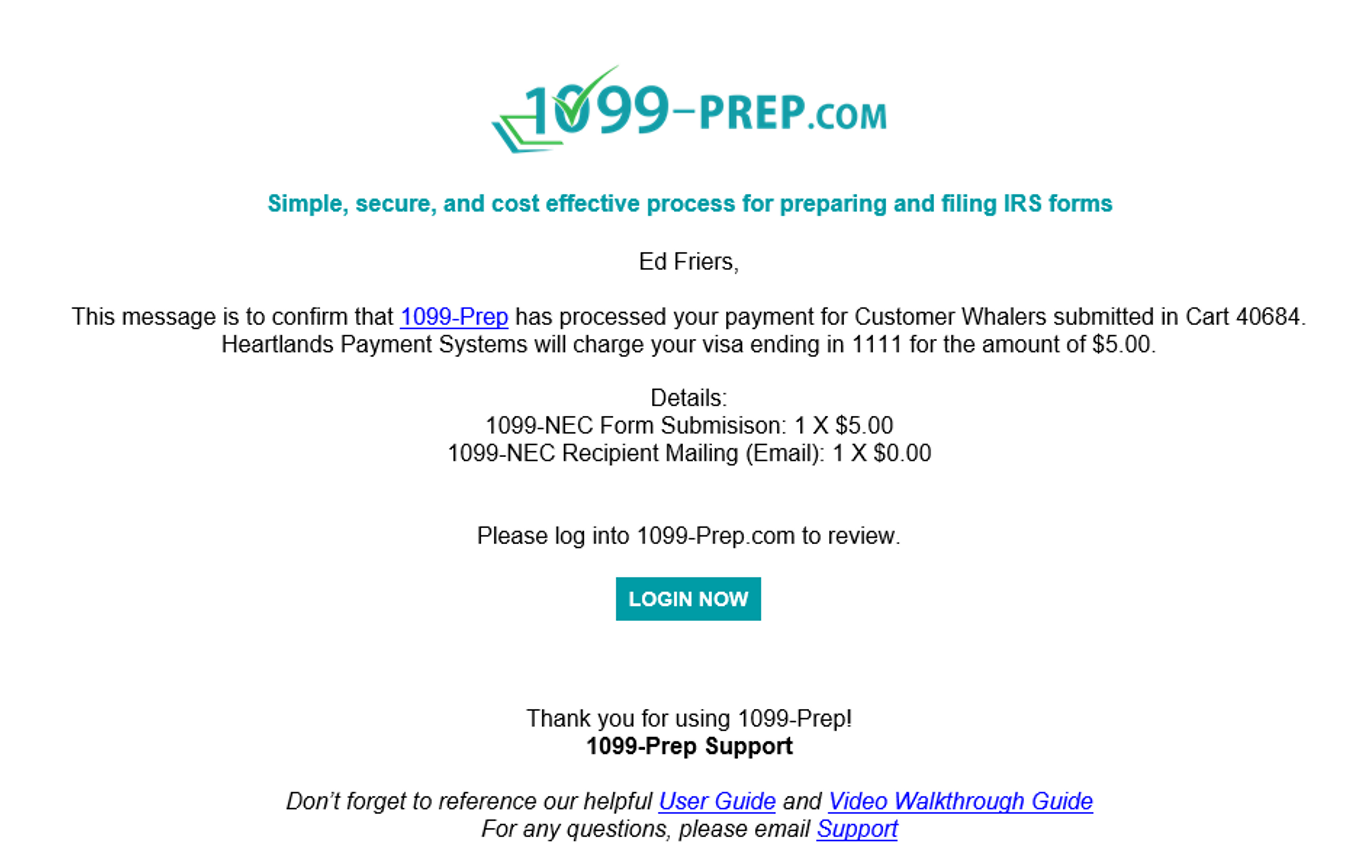

If no errors are found, your payment method is charged, and the forms are submitted to the IRS and/or state. 1099-Prep will send a “Cart Submissions Results” email to the email address associated with your 1099-Prep account.

You can keep track of the status of your submission by returning to the Forms section of the customer account in the Dashboard and viewing the Status (see Submission Process and Form Status).