Accessing Statements to Recipients

1099-Prep allows recipients named in tax forms to access copies tax statements emailed to them by the tax payer in 1099-Prep (see Sending Statements to Recipients).

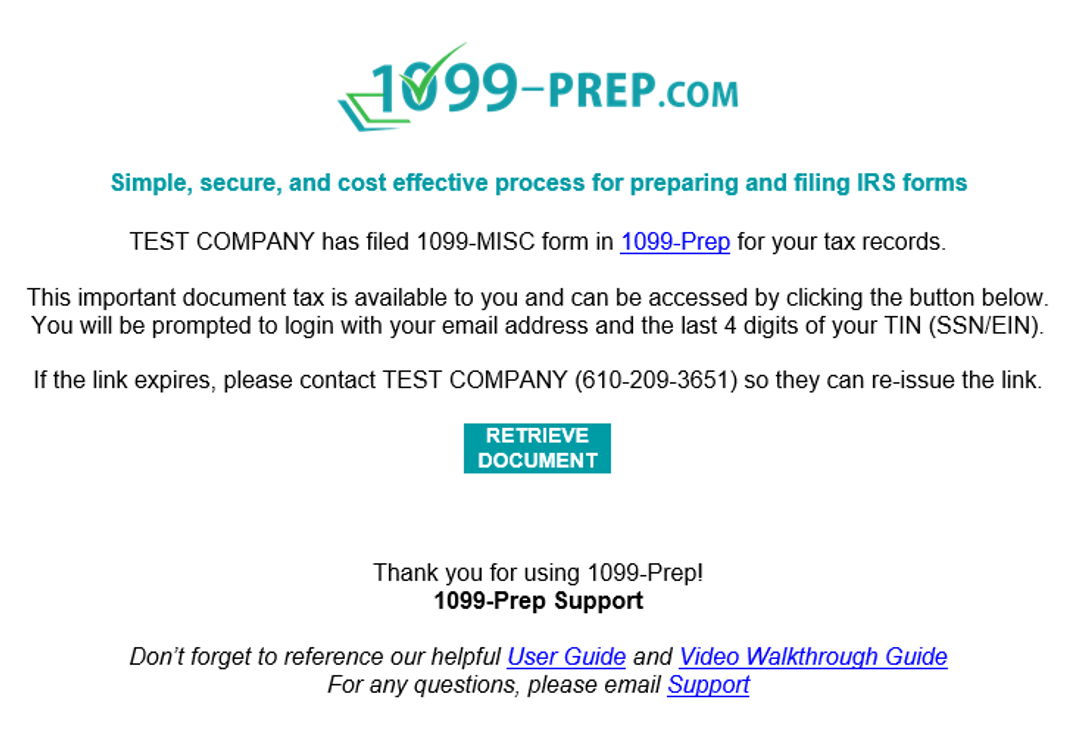

When payers submit forms to the IRS and/or state, they can select to send an the “Recipient Forms” email to recipients of tax statements. The email contains a link that allows recipients to sign into 1099-Prep using the last 4 digits of their TIN, SSN, or EIN number.

To access tax statement of the recipient, you access the “Recipient Forms” email from the email address you designated for tax correspondence from the payer.

To access 1099-Prep:

-

Open the “Recipients Form” email from your email inbox.

NOTE: If you cannot find the email, be sure to check your Junk mail.

-

Click the Retrieve Document link in the email.

NOTE: Links expire once you access statements. If you need a “Recipient Forms” email resent with an active link, contact the payer of tax forms. For other issues, use the 1099-Prep support email.

-

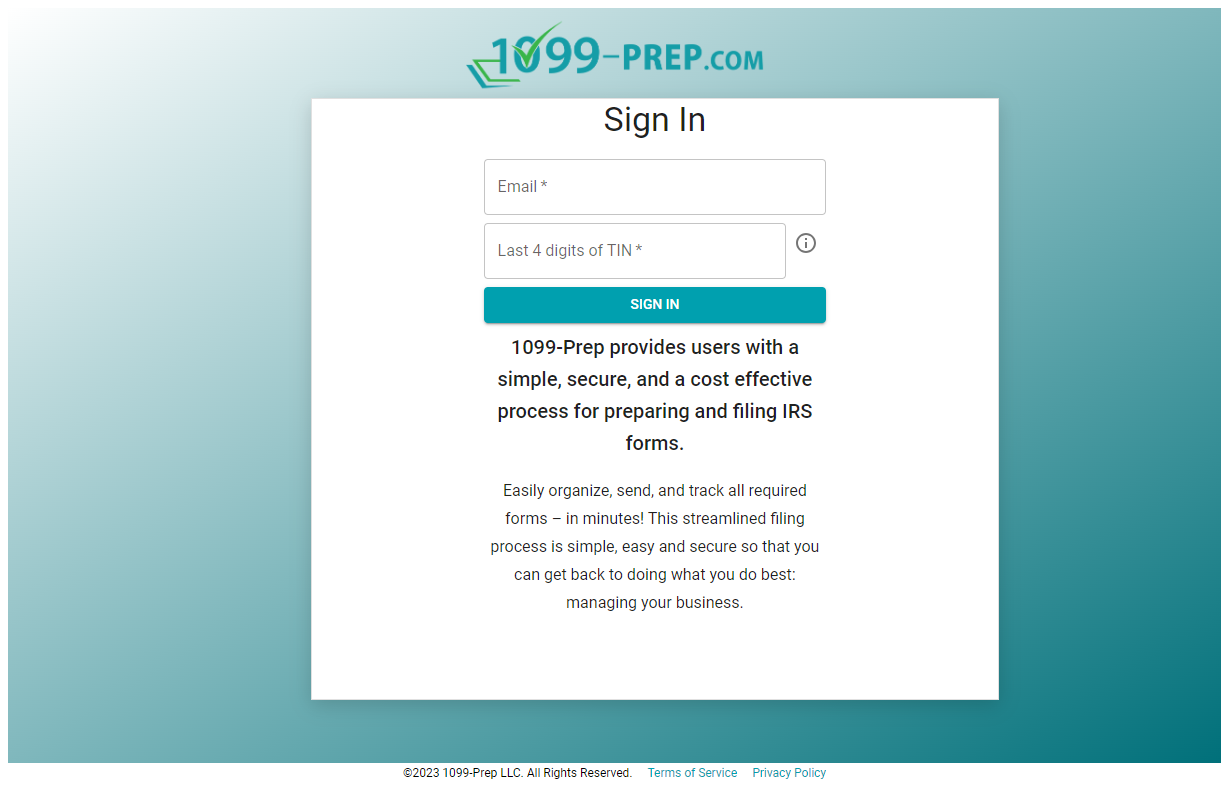

Enter in the Email field the email address you used to access the “Recipient Form” email.

-

Enter the in the Last 4 digits field the last 4 digits of your TIN, SSN, or EIN number.

-

Click SIGN IN.

NOTE:

-

If you cannot login, contact the payer to ensure the TIN, SSN, or EIN number is correct on tax forms.

-

If you are locked out from logging in, contact the payer of tax forms to an access email to be resent.

-

-

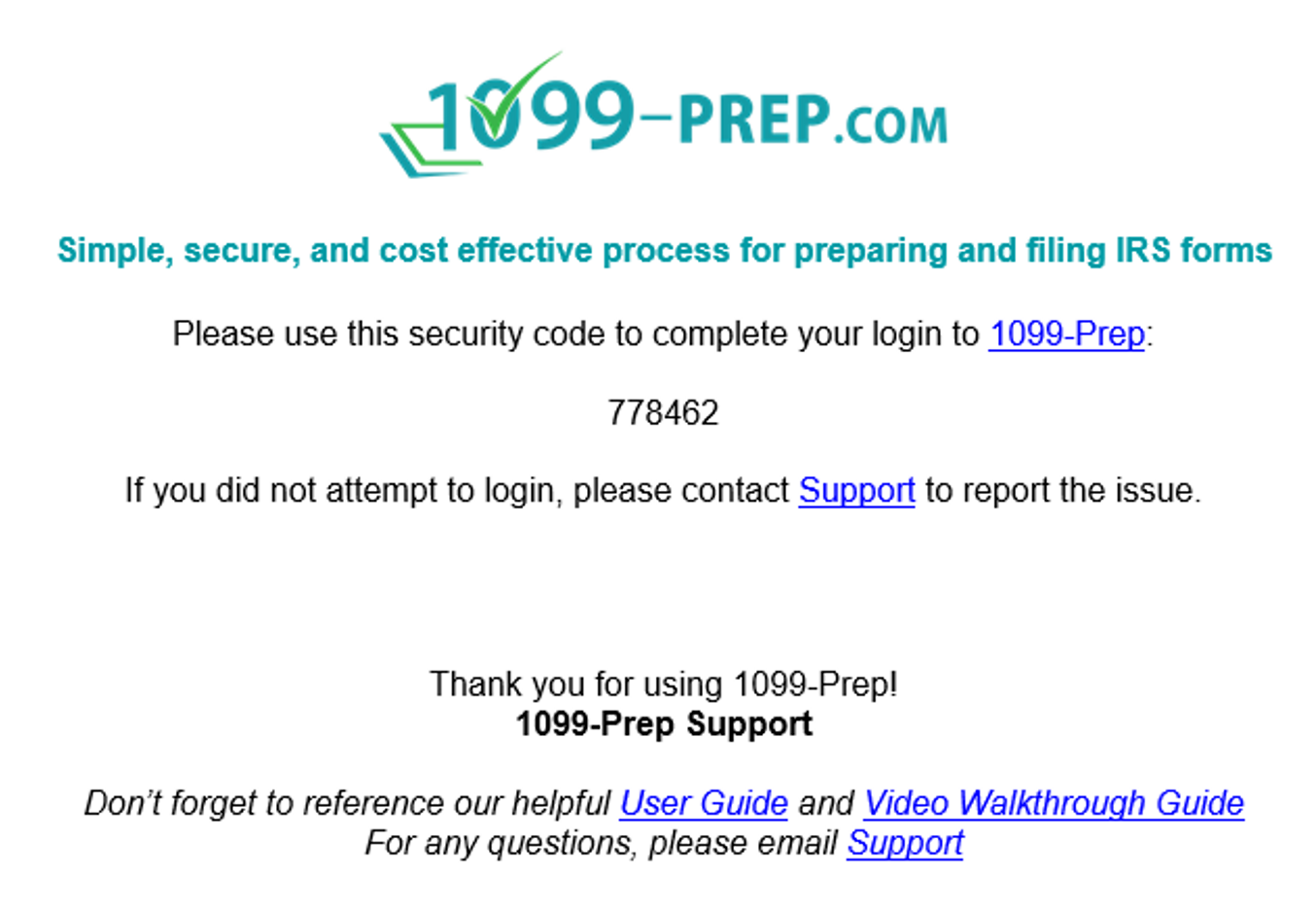

Leave the Sign In page open in your web browser and access your email inbox.

-

Open the “1099-Prep Security Code” email in the inbox. Note the Security Code in the email.

-

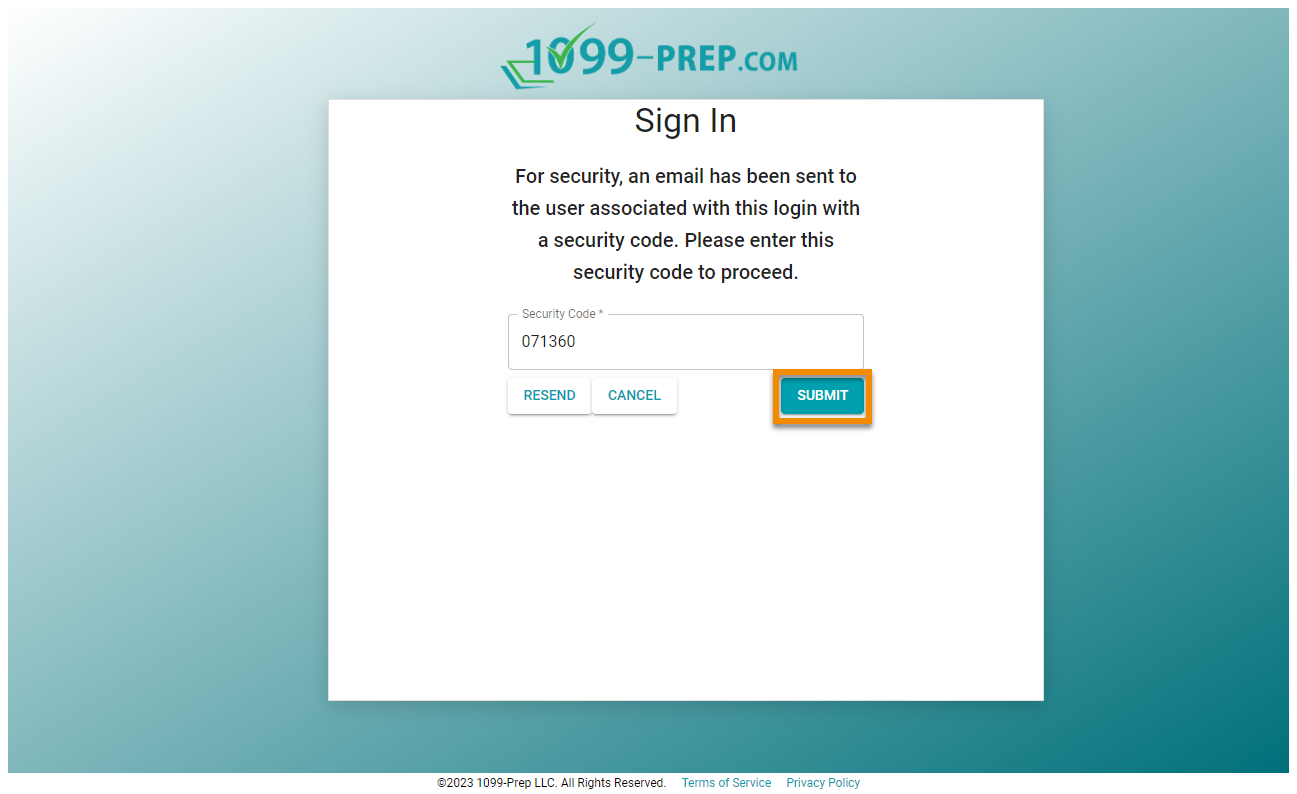

Return to the Sign In page and enter in the Security Code field the code from the “1099-Prep Security Code” email.

-

Click SUBMIT.

-

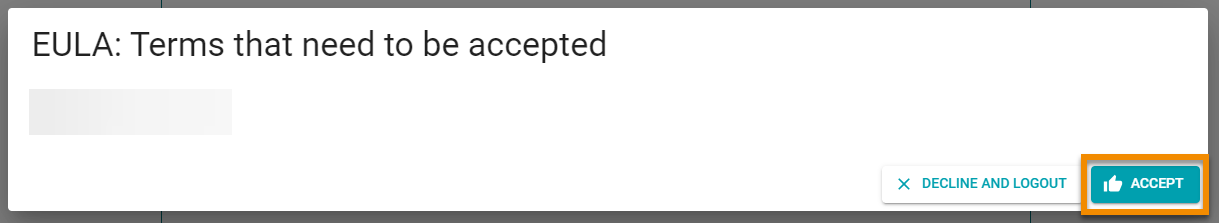

Click ACCEPT in the EULA Terms prompt.

Statements sent to the recipient displays listed in 1099-Prep.